The Payroll Tax is a fee that the State requires from employers for transactions corresponding to the labor relations they have.

The items taxed locally for the payment of payroll tax include salary and employee benefits.

Although it is a local tax (i.e., each state treasury office is responsible for collection), failure to pay may result in penalties or fines.

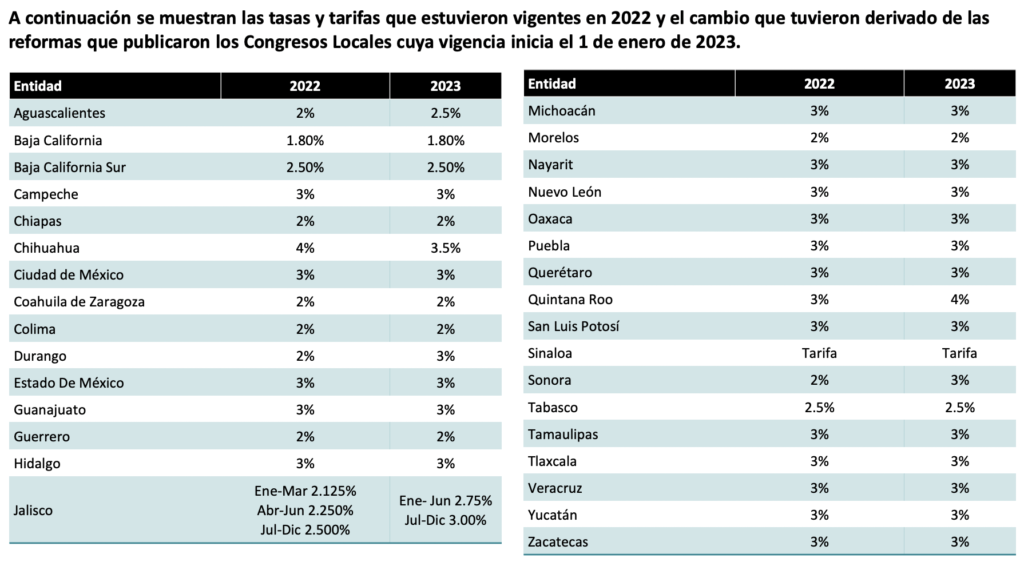

In relation to the compliance with the obligations regarding the Payroll Tax / remuneration for personal work in the 32 Federal Entities of the country, we share with you the provisions in force for the fiscal year 2023 that we consider important.

New Payroll Tax (ISN) values for 2023

As we can see, the state with the highest ISN is Quintana Roo, which reached a rate of 4%.

Did you already include these values in your payroll calculations?

Remember that if you have a payroll software, such as Zentric, these calculations are performed automatically and without errors.

Say goodbye to payroll stress!

Remember that to keep up to date with the payroll world, this is the best place.

See you next time!