A few days ago, we had a webinar workshop with our payroll experts, David Lozada (Tax Master) and Carlos de León (CEO of Zentric) where they showed us how to make the Annual Declaration of the Labor Risk Premium.

Now we bring you an excerpt of what we talked about on that occasion.

First things first:

The Occupational Risk Premium (PRT) is an obligation that employers must submit each year to the Mexican Social Security Institute (IMSS) as a consequence of accidents or illnesses suffered by their workers as a result of the activity they perform.

The annual occupational risk declaration is filed in the month of February of the year following the year in which the accident rate is determined, i.e., the declaration for fiscal year 2022 will be filed no later than February 28, 2023. February 28, 2023 at the latest..

How to make the Annual Occupational Risk Premium Declaration step by step?

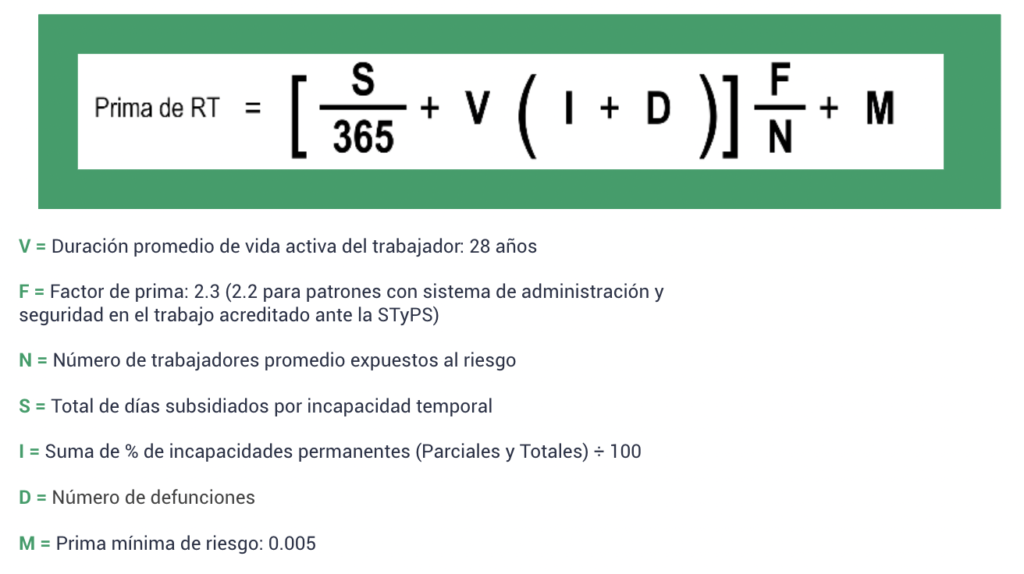

The first thing to know is the formula for its calculation.

Article 72 of the Social Security Law (LSS) states that

"For the purposes of setting premiums to be covered by the occupational risk insurance, companies must calculate their premiums by multiplying the company's loss ratio by a premium factor, and 0.005 shall be added to the product.

The result will be the premium to be applied to the contribution wages, in accordance with the following formula:"

Now, we must follow the next steps, starting with Logging in to SUA. We recommend that you have the latest version 3.6.3.

Look on the left side menu for the Occupational Hazard Premium Statement (third option).

When clicked, 3 options will be displayed; click on the first one.

Now you must click on the "Calculate" button.

It is important to remember that before doing this, you must have all the information loaded and exported in the system so that the SUA can work.

Once the system has finished calculating, you can exit and go to the next screen, which you will find in the next menu option.

Do you remember the formula we saw earlier? Here the system will make use of it to perform the calculation.

Once it finishes processing, it will give you the option to generate the file.

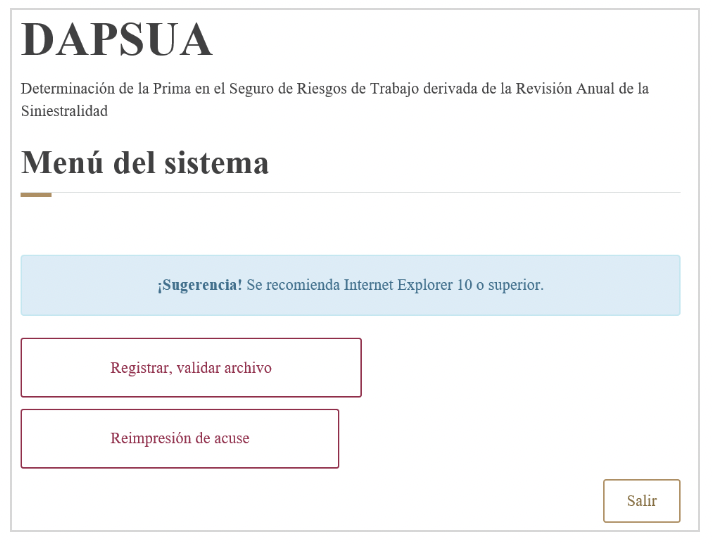

That's it, you have the file! Now you have to go to the IDSE portal and click on the DAPSUA option.

Once there, you must "validate the file" that you previously downloaded from the SUA.

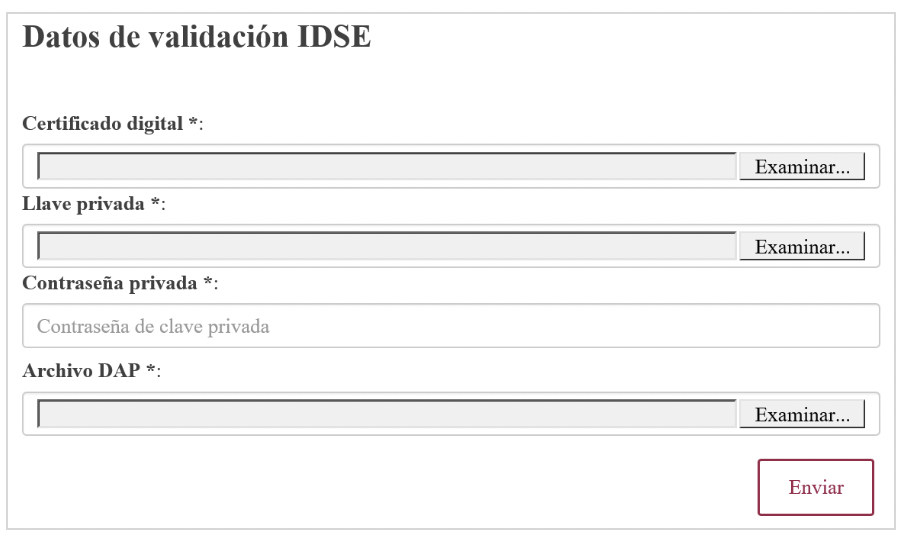

Once you validate the file, you will be prompted to enter your IDSE validation data.

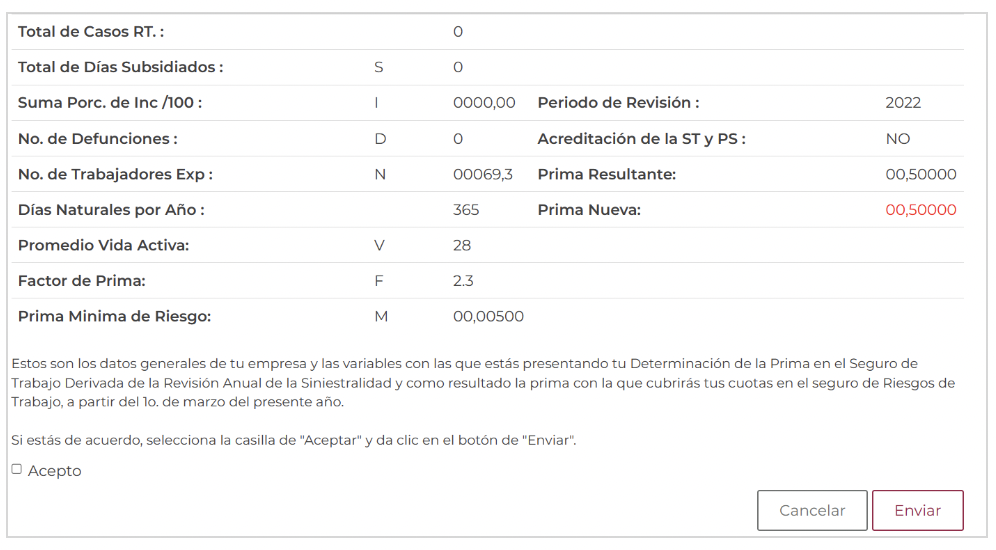

The system will give you a summary. The only thing you have to do after that is to click on "Submit".

Once you have the folio number, you can be sure that the process is complete.

What happens if I do not file the Annual Workers' Compensation Premium Statement?

Article 304 B (LSS). The infractions indicated in the preceding article shall be sanctioned considering the seriousness, particular conditions of the offender and, if applicable, recidivism, in the following manner:

III. Those provided for in sections VI, IX and XV with a fine equivalent to the amount of 20 to 210 times the UMA.

| MINIMUM FINE | 20 UMA | $2,074.80 |

| MAXIMUM FINE | 210 UMA | $21,785.40 |

It may not seem like much, but it is definitely in our best interest to have everything in order with the authority to avoid more severe penalties in the future.

If you want to know the whole process in more detail, we invite you to review the session we had live.

Also, you can download, fully editable, the presentation of that session.

Finally, we invite you to subscribe to our magazine-blog to keep up to date with the world of payroll.

See you next time!