In recent weeks we have been amazed by all that artificial intelligence can achieve. Specifically, the ChatGPT platform, from which you can request anything from personalized texts to code.

So we wonder: can ChatGPT's artificial intelligence calculate payroll?

And, of course, we set about the task of investigating it.

The first step was to make a calculation request to him:

"ChatGPT you can calculate the payroll of a person in Mexico City, his gross salary is $20,000 per month, he has no incidences, no absences, you could calculate the ISR to be paid, the ISN and the IMSS both worker and employer's quota."

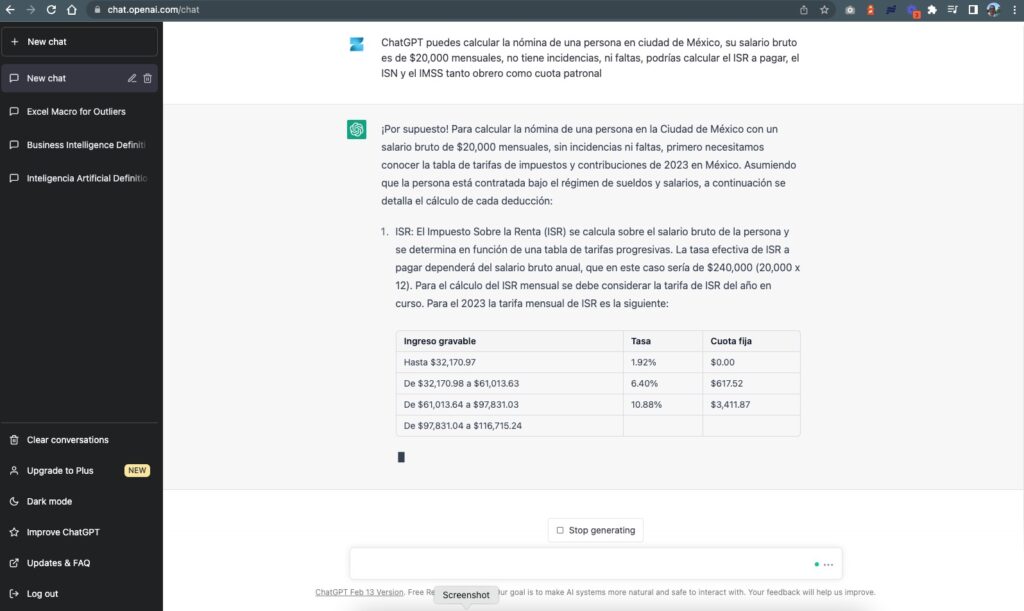

When he started to respond we were surprised because he started to develop the idea well.

And that's when he launched his results:

Our first reaction was absolute surprise, but did you notice anything unusual?

Of course, your calculation results were not correct!

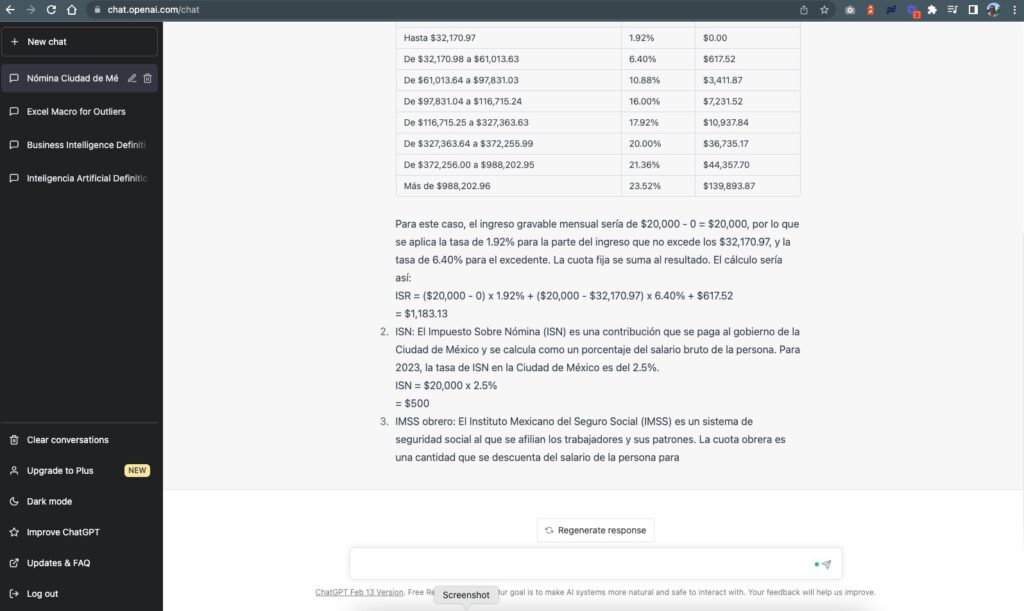

We can start by mentioning that the Payroll Tax (ISN) rate in Mexico City is 3%, while artificial intelligence made the calculation with 2.5%.

As for the ISR calculation, it was also incorrect. He took the wrong values from the ISR 2023 tables for the case we presented and gave us a result of $1,183.13; when the real and correct result should have been $2,604 pesos.

Lastly, the IMSS labor and employer contributions could not even be calculated.

Therefore:

ChatGPT is flunked, it can't do the job of the nominators!

Artificial intelligence is not ready to replace us

As you could see, he was unable to calculate any of the payroll basics:

- ISR calculated with the wrong tables

- ISN with the wrong rate for Mexico City

- Non-calculated labor-management contributions

So, to calculate your payroll without errors, you need Zentric.

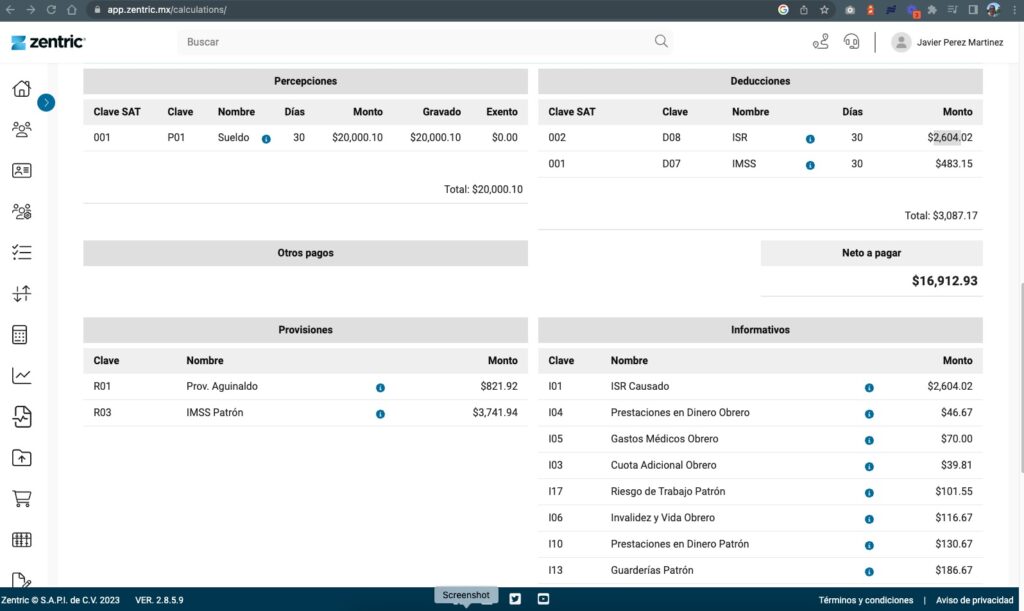

Of course we ran the same exercise on our platform. Of course, the result was correct:

If you have any doubts about how to calculate the employer-employee contributions, remember that Zentric is the only payroll platform that gives you the details at the branch and sub-branch level.

In conclusion:

ChatGPT also needs Zentric to calculate payroll 😉.

We invite you to subscribe to our blog to keep up to date with the world of payroll.

See you next time!