Some of you may think it is too early to prepare the payroll for the 2022 profit sharing, but we are really on schedule to have that payroll ready.

As a result of the amendment to the Federal Labor Law of April 2021, in which section VIII was added to article 127, a mechanism is established to limit the amount to be distributed of the employee profit sharing (PTU), for which reason, as of said amendment, an additional calculation must be made to determine the maximum amount to be distributed to each employee.

Article 127. The right of workers to participate in the distribution of profits, recognized in the Political Constitution of the United Mexican States, shall be in accordance with the following rules:

...

VIII. The amount of profit sharing will have a maximum limit of three months of the employee's salary or the average profit sharing received in the last three years. three months of the employee's salary or the average of the profit sharing received in the last three years; the amount that is more favorable to the employee will be applied.

And what does this limitation have to do with the preparation of the 2022 PTU payroll in March 2023?

Well, there are two reasons to have that payroll ready this March.

The first reason is accounting-financial.

Each legal entity must prepare its financial statements for the year, in this case those corresponding to the year 2022, and these reports must consider the costs and expenses corresponding to such period.

PTU is an additional cost and expense item that must also be provisioned (recorded as a cost and/or expense for the year 2022 recognizing a liability payable in 2023) in the accounting to be reported in these 2022 financial statements.

According to the provisions of the General Law of Mercantile Corporations, financial statements must be issued for approval by the General Shareholders' Meeting, which must be held within four months following the close of the fiscal year; therefore, we are already in the third month and the time to have those financial statements ready to be submitted to the Board of Directors and the Supervisory Board, or to the sole administrator and the Statutory Auditor, is coming to an end.

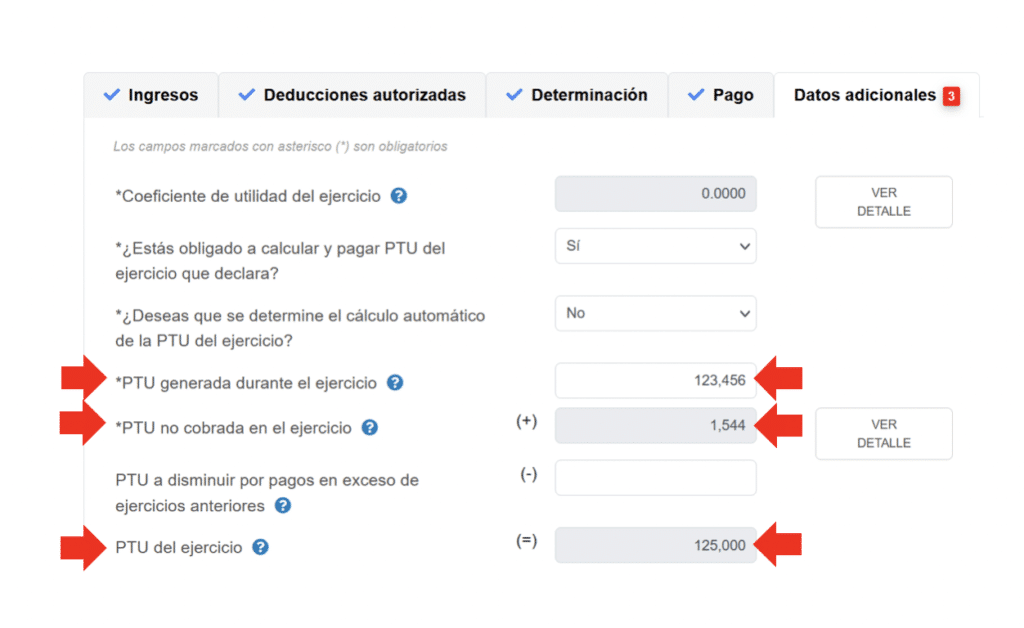

The second reason is that, when filing the employer's annual tax return, theamount of PTU to be distributed as well as the amount of PTU not distributed corresponding to the previous year must be reported, and for employers constituted as legal entities taxed under the general tax regime, the deadline to file their annual return is March 31, so there is not much time left to have the amount to be distributed ready, which must be entered in the annual return form as shown below.

How is the calculation of PTU 2022 made in 2023?

Now, the determination of these amounts is no longer the same as it used to be when you multiplied the amount of the PTU base profit by 10% and obtained the total amount to be distributed; today it is necessary to make a complete calculation of the PTU payroll to know if the maximum amount applies to any employee and, therefore, the total amount to be distributed differs with respect to the 10% of the PTU base profit.

The sum of amounts in excess of the maximum amount to be distributed for each employee is no longer obligatory to be distributed, and for this reason, it is not correct to consider it as a cost or expense for accounting-financial purposes, nor to include it in the amount to be included in the annual tax return form.

And this data is only obtained on an individual basis, worker by worker; there is no way to calculate it globally, but only on an individual basis.

For both of the above reasons, it is necessary to calculate your PTU payroll as soon as possible in order to obtain the precise amount to be considered for accounting and tax purposes and, while the 60-day period elapses after the date on which the annual tax return must be filed, the other procedural obligations required by law must be completed, as well as covering the formal requirements regarding the distribution of profits to employees, such as the following:

- Integration of the joint committee.

- Preparation of the distribution project (which is the OCT payroll and would already be ready to be delivered to the members of the joint committee).

- Publication of the project in a visible place in the establishment.

- Attend to the observations made by the employees regarding the amount of PTU that corresponds to them.

- Call to former employees who are entitled to receive PTU.

- Payment of the amount to be distributed to each employee.

- Stamped payroll receipts for the payment of PTU.

So, let's start with the calculations of this payroll, as time goes by and this information is already required.

Don't forget that the best way to stay up to date on the world of payroll is by following our blog.

See you next time.