Both individuals and corporations get into a state of nervousness when it comes to start reconciling prior to the annual tax return.

But there is a tool, provided by the SAT, that can make our life much easier, the Payroll Viewer.

The information contained in it could even serve as a pre-filling prior to the annual declaration.

There are two versions of the Payroll Viewer, one for workers and one for employers.

This time we will focus on the second one.

What is the Payroll Viewer for the Employer?

It is used to consult the payments made to your employees cumulatively, as well as to verify the information individually for each one of them that you have issued them a payroll voucher.

This will allow you to reconcile the tax withheld against the tax paid in provisional income tax payments, withholdings for salaries and salaries assimilated to salaries.

It is important to mention that it contains information from 2018 and later.

How to use the Payroll Viewer for the Employer (Step by step)?

Using the Payroll Viewer is much easier than you think.

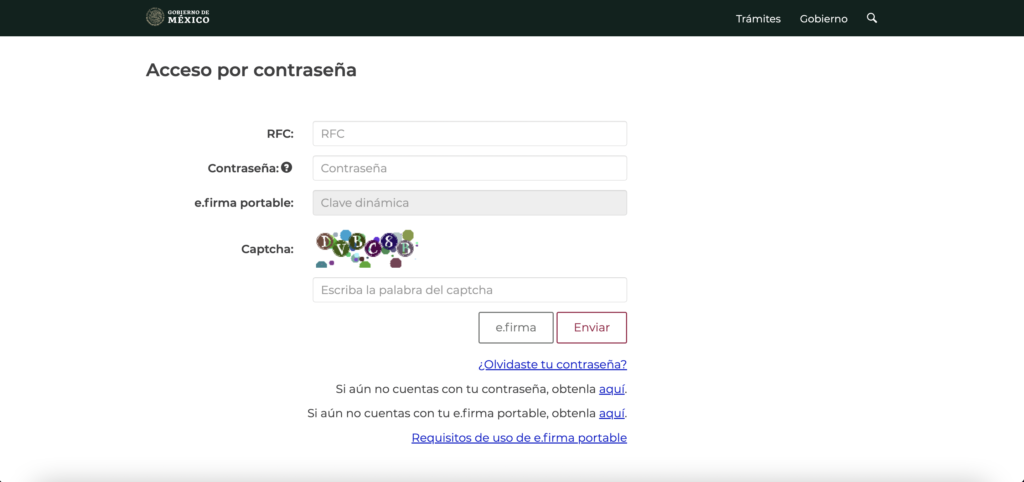

(Before you start, don't forget to have your RFC, password or e.firma)

We will now go through the steps:

Q1: Login to the SAT Portal

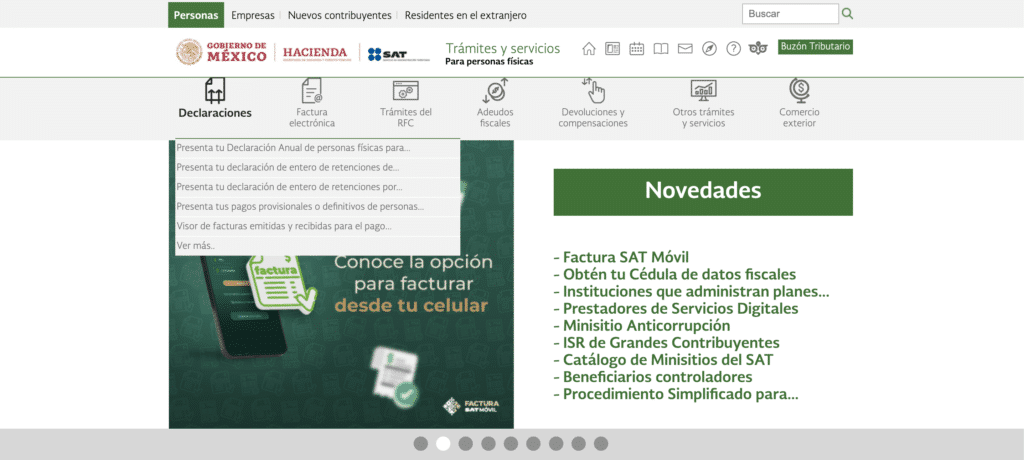

Q2: Click on the "Statements" menu and then on the "See more..." option.

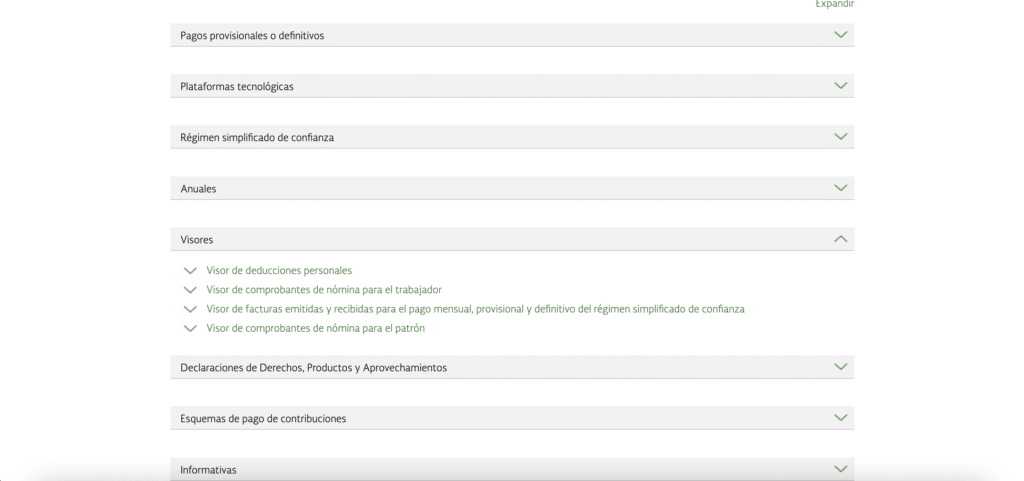

Q3: On that page scroll down until you find the "Viewers" submenu and click on "Payroll Voucher Viewer for Employer".

Q4: You will see the following screen, click on the "Start" button.

Q5: To access, you must fill in the fields with your RFC, password or e.firma.

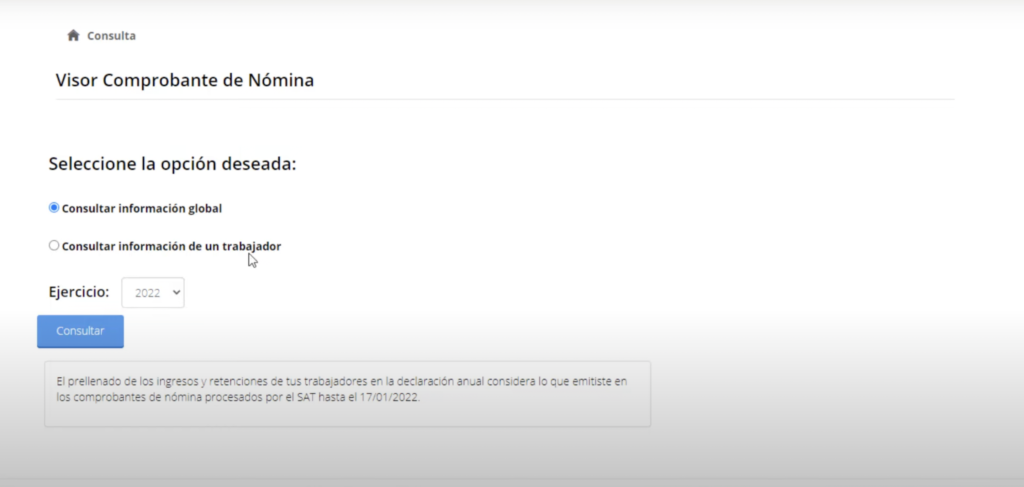

Q6: Once inside, you will see two options: "Consult global information" and "Consult information of a worker".

Q7: To consult the information of a specific worker, just type his/her RFC, select the fiscal year you want to visualize and click on the "Consult" button.

Q8: This time, we are going to focus on the "View global information" option. To do this, just select the option, choose the Exercise you want to view and click on the "Consult" button.

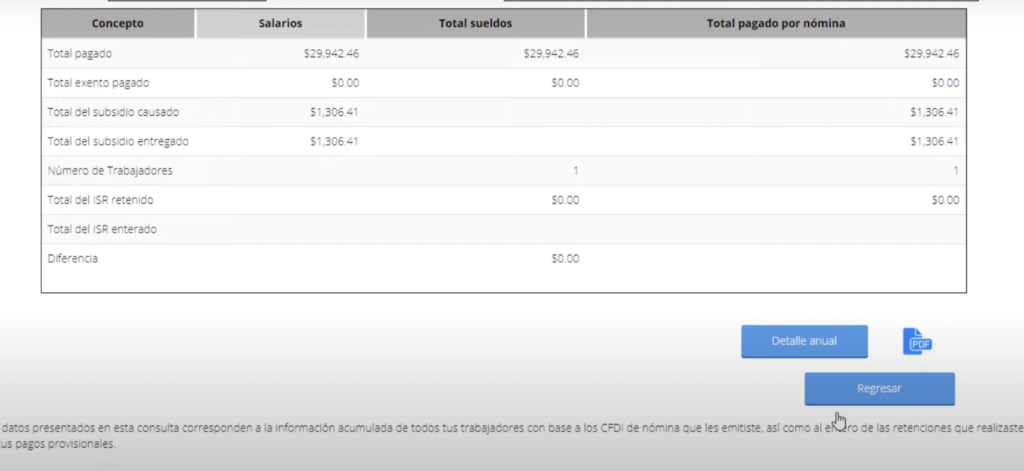

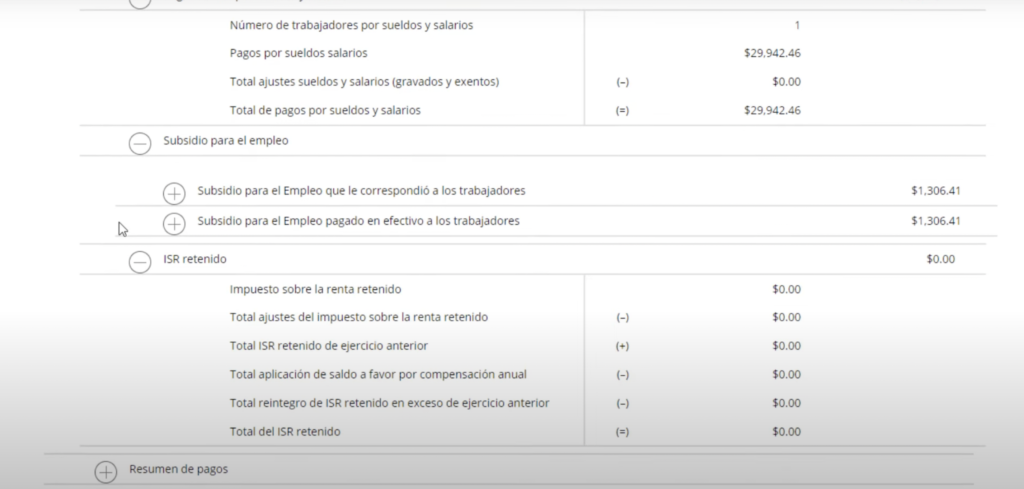

P9: You will see all the information broken down, for all the payroll receipts that you have stamped during the selected date (or Fiscal Year).

Here you will be able to see, globally: Concepts, Salaries, Total salaries and Total payroll paid.

You have the option to view the "Annual Detail" by clicking on the button or download the information in .PDF format

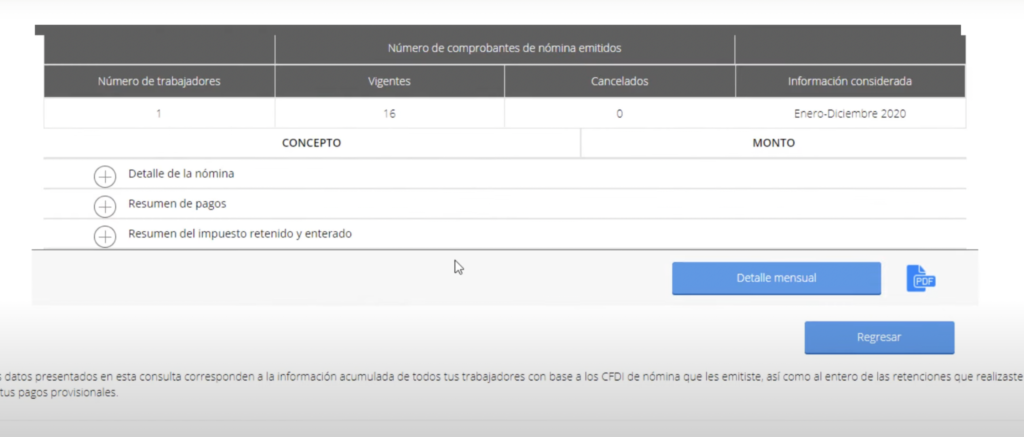

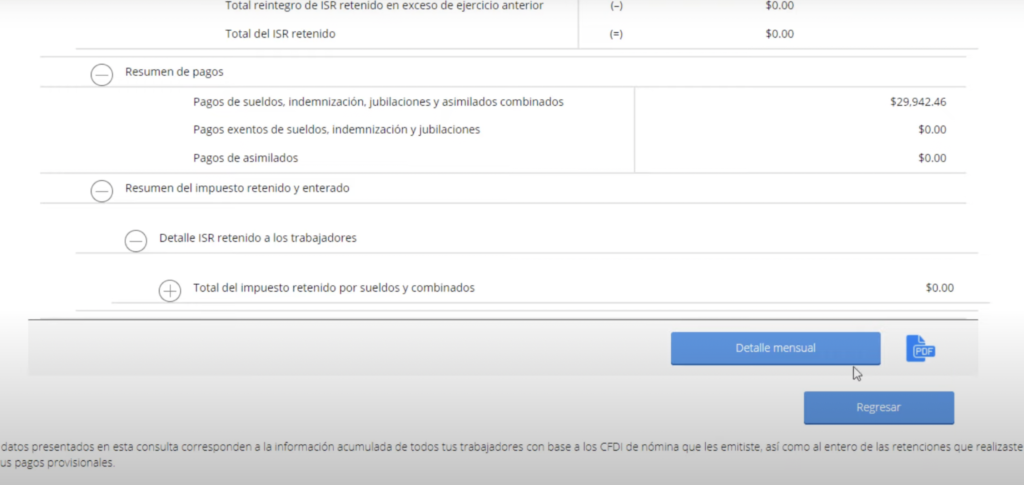

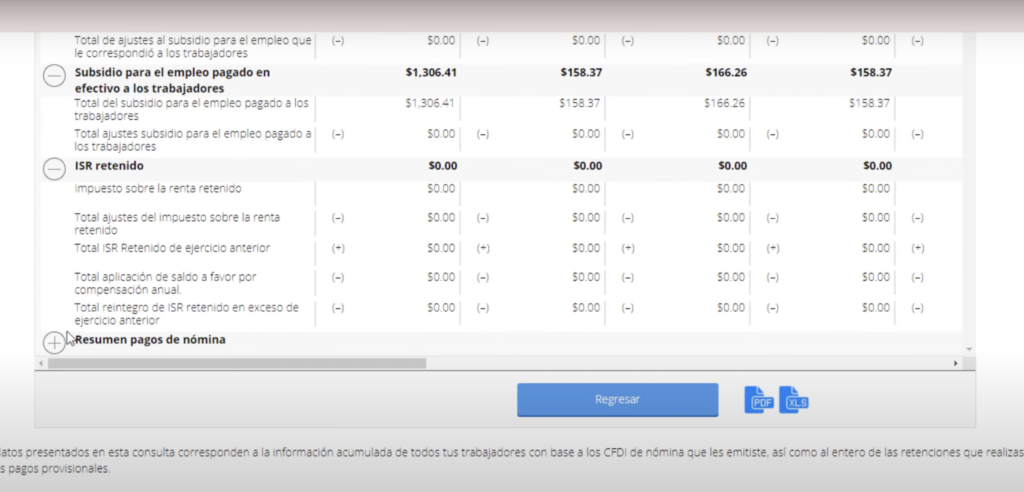

P10: If you click on "Annual Detail" you will be able to see the "Payroll Detail" (payments, subsidies and income tax), "Summary of payments" and "Summary of tax withheld and paid".

P11: If you click on any "+" symbol you will see the detail of each concept.

Q12: If you wish to have an even deeper detail, you can do the monthly visualization. To do this, just click on the button "Monthly detail".

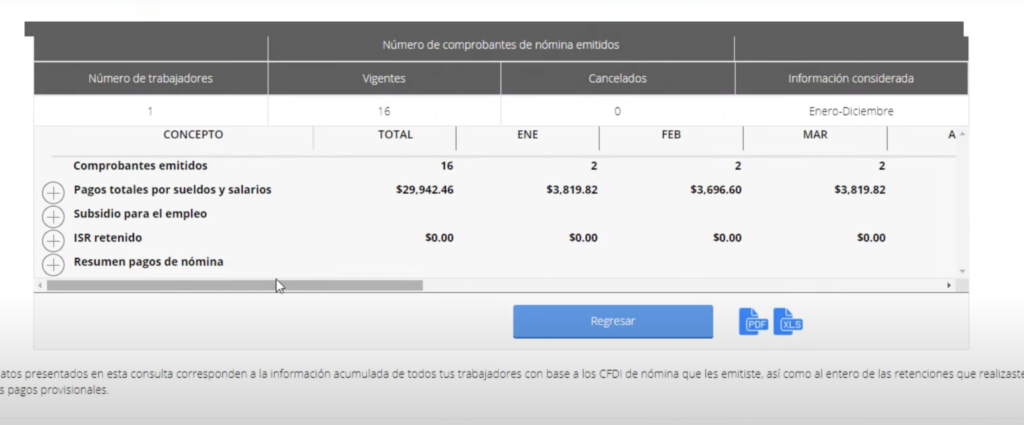

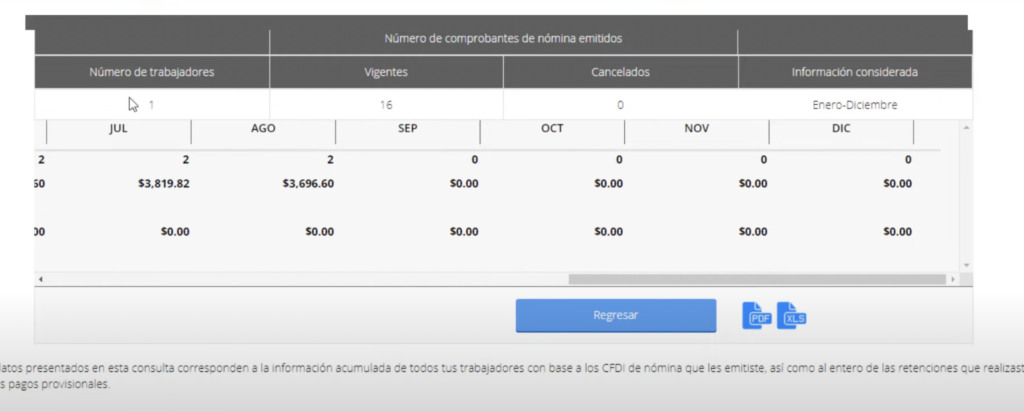

Q13: If you select "Monthly detail", you will be able to see the information broken down month by month, from January to December.

Here you will also be able to visualize:

- The number of employees

- Current XML

- Canceled XML

- Information considered

Q14: As we saw in the "Annual Detail", if you click on the "+" symbol you will be able to see the full breakdown of the annual information.

But if you still want more detail, you can download a .PDF or .XLS file from the blue icons.

Conclusion

And that's it! See how easy it was to look at all the information in the SAT Payroll Viewer?

Remember that it is very important to make a reconciliation of your accounting, one reconciliation with the SAT (stamped) and another with the information you have in your payroll.

It is extremely important that these 3 data are exactly the same.

It is also important to mention that all this process, and many others, can also be outsourced with Maquila de Nómina.

Would you like us to make a Payroll Viewer guide for workers so you can share it with your collaborators? Write to us in the comments.

See you next time!