The first generation of pensioners under the pension system of the Social Security Law of 1997 would begin to retire in 2021, but due to the not very beneficial effects for the workers of such system (which through the tripartite contributions of employers, workers and the Government to the Retirement Fund Administrators -AFORE- were making deposits during the working life of the workers), two years ago the Social Security Law was amended to modify, in favor of the employees, the benefits of such system based on an increase in the contributions to the AFOREs.

This change to the Law was made in December 2020 and consisted of increasing the premiums for the Old Age and Advanced Age Severance Insurance ( CEAV) contributed by the employers.

However, this amendment to the Law did not take effect for a certain period of time. The effective date of this change was established as of January 1, 2023.

For two years no attention was paid to this reform, but as we are now a little over a month away from the beginning of this increase in the social burden for employers, the need to prepare organizations for this change and its consequent increase in payroll costs is becoming evident.

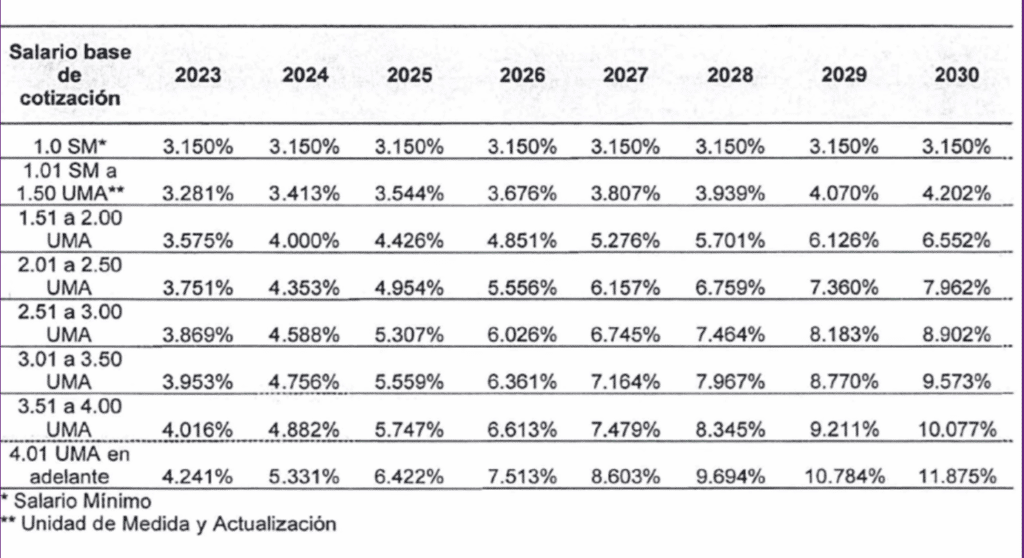

CEAV's employer's contribution until 2022 is 3.15%, but as of 2023, a period of eight years begins during which this contribution will be increased "smoothly" and in stages, as shown in the following table:

As can be seen, the contribution is no longer the same for all workers, but is staggered depending on the base salary of each worker.

As the table stands, we can see that it is difficult to apply because the ranges apparently cover all salaries, starting from the minimum salary up to the upper salary limit established by the Law.

But in reality this is not the case and here is an example.

Example of the cost of severance at advanced age and old age

Let's assume that a worker's Base Contribution Wage (SBC) is the equivalent of 2.5 UMA (something like $240.55 taking the value of the UMA for November 2022 which is $96.22).

The 3.751% premium would apply to this salary, but what percentage would apply if your salary was $241.00?

If we divide the 241.00 by 96.22, which is the value of today's UMA, the result would be equivalent to 2.504677 UMA, therefore, what would be the premium to be applied to such salary?

Because it is higher than 2.50 UMA and lower than 2.51 UMA ($241.5122).

So far, no one has the right answer.

As well as this complication of interpretation, there are other deficiencies in the way in which the percentages of the premiums for this branch of severance at advanced age and old age were fixed, which we will be addressing in the next few days.

In the meantime, don't forget to stay tuned with the notes that we are uploading to this blog every week.

See you soon!

[December 2020, an amendment to the law was made to increase the premiums for the Old Age and Advanced Age Severance Insurance (CEAV) that we, the employers, contribute. This amendment will take effect as of January 1, [...]

Comments are closed.